15% for Financial Freedom (Step 10: The Retirement Savings Benchmark)

One of the most common personal finance questions is: "How much should I be saving for retirement?" While there are countless "what-ifs" surrounding that question, let's boil it down to a solid benchmark. 15% for Financial Freedom. Saving and investing 15% of our gross pay every paycheck will have us solidly set for retirement at the end of our career. Today we'll explore the math and show what 15% will get us in retirement and what other factors could adjust that number up or down. We'll also touch on one of the Financial Independence Retire Early (FIRE) movements favorite metrics, the 4% Rule, as a solid baseline for how much we should have saved before taking the plunge into retirement.

Wondering how we got here? Check out the Base10 Basics for the 9 Steps we've taken before this on our journey in personal finance.

The Big Question: How Much Should I Save?

Saving for retirement is one of the most long-term financial plans that most people will ever consider. It can seem like a monumental task that may never seem to end when we're in our early career, but one that is certainly worth starting earlier than later! Time is one of our best friends when saving for retirement. The earlier we start, the more time we have to let compound interest do its work.

That said, over our lifetimes, there are a lot of variables and uncertainty that we need to plan around, both while saving for retirement and even in retirement. But planning for this uncertainty is one of the most important aspects of personal finance. Once we make the decision to retire, the last thing we want is to go back to full-time work.

The variables in planning for retirement include:

- Longevity

- Market Returns

- Retirement Lifestyle

- Social Security

- Pension

- Age of Retirement

Some of these we have control over or can plan for, like retirement lifestyle and if our employer offers a pension. But others, like longevity and market returns, we have much less control over and need to make assumptions during our planning. The more data-driven and conservative we make these assumptions, the more likely we are to have a stable retirement. We'll look at how changes in these assumptions affects our retirement planning next.

Planning Assumptions

Choosing, refining, and understanding each of these assumptions is key to our overall retirement planning strategy. Let's take a look at median assumptions first, then more conservative assumptions for those of us who want to extra assurance.

Longevity

The longer we live, the more money we'll need!

Median: 78 Years

Conservative: 95 Years

Market Returns

Median: 7%

Conservative: 6%

Retirement Lifestyle

This one is really based in our own personal lifestyle and goals. Some people spend more money in retirement, while some spend less. Taking the time to dissect this assumption is very valuable to our planning process. A great starting point is to use our current salary, then adjust it up or down based on how we envision our retirement lifestyle.

Median: 100% of current salary

Conservative: 125% of current salary

Adjust up to +/- 25% based on projected lifestyle

Social Security

Close to retirement already? You'll probably be able to pull your full social security amount without much worry. Just starting your career? Estimates are already putting a ~25% reduction in social security benefits by the time you start receiving benefits. Not sure how much you'll be receiving?

Median: Get your estimate here.

Conservative: Knock off about 25% from the estimate

Pension

Not many employers have pensions anymore. Thankfully, federal employment is one of the few still around that do. Every pension system is unique and requires research to estimate what our retirement benefit would be at retirement. They are generally based off the numbers of years we spent at that employer.

Median: Need to research your employers pension system.

Conservative: Assume you retire at the earliest age possible. You can almost always stay longer.

Age of Retirement

Our actual age of retirement is more of an output than an input sometimes, but if we are wanting to retire on the earlier end, it can drive us to need to save more in order to reach that goal. Certain factors like pensions and social security make the possibility of retirement easier as we age and are eligible for those benefits.

Median: Age 62 (Lines up with when we can start receiving social security benefits.)

Conservative: Similar to pensions, assume you retire at the earliest age possible. Federal employees minimum retirement age is 57 (based on years of service).

Why 15% Works

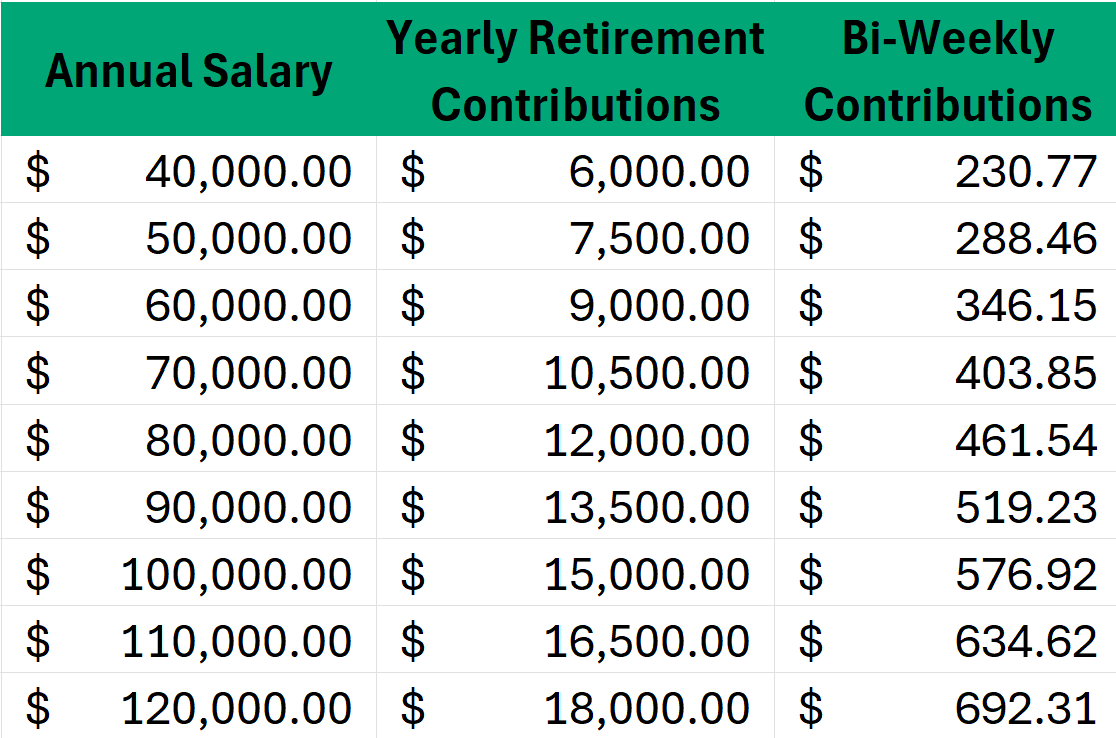

Now let's look at what 15% of our gross income looks for different annual salary amounts broken down to a bi-weekly contribution amount.

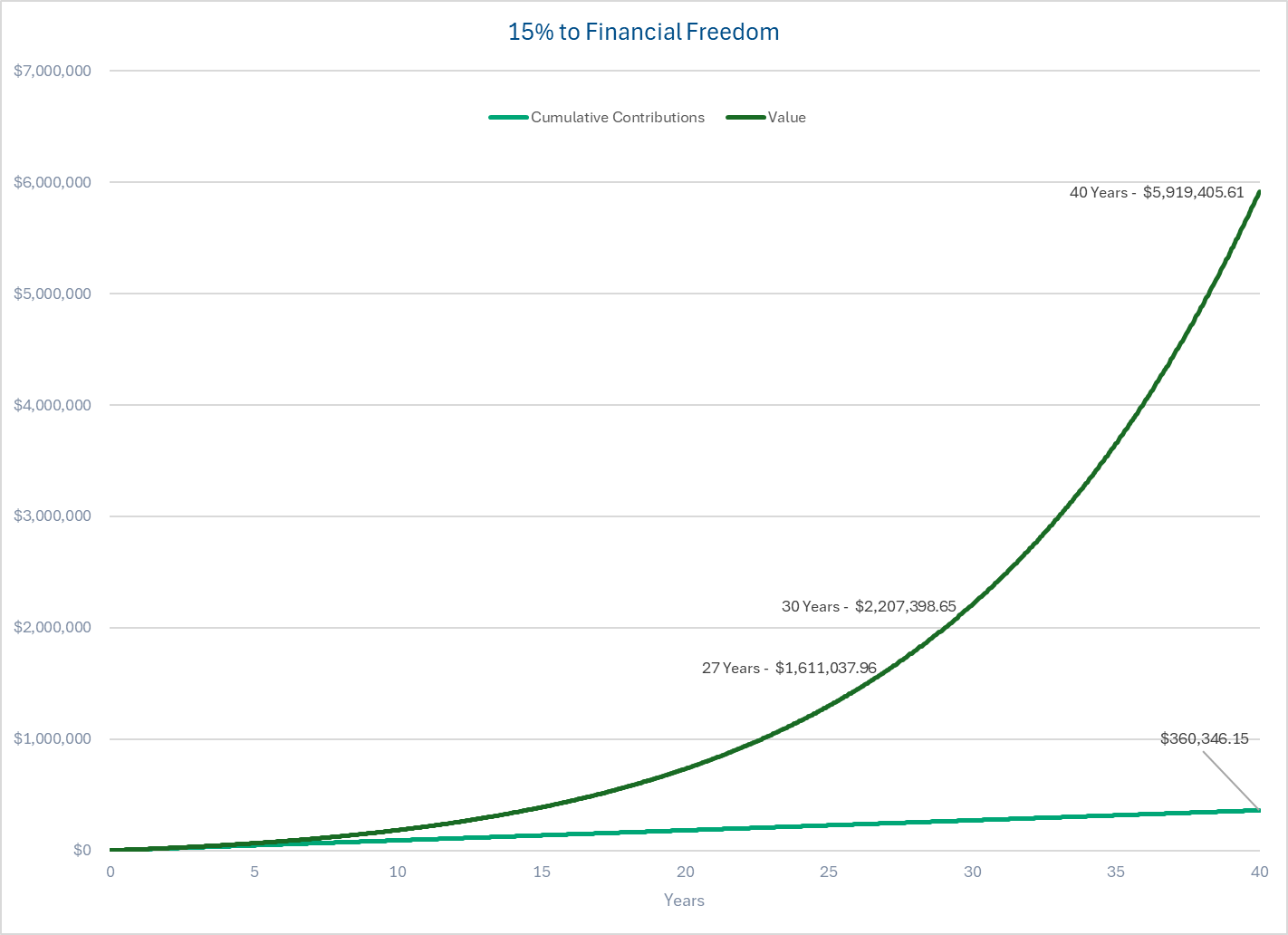

Consistent investing here and the magic of compound interest will cause our account balances to grow exponentially over time. Let's take a look at what an annual salary of $60,000 looks like after investing 15% after 30 and 40 years.

After 30 years of consistently investing 15% of our gross salary, we're left with over $2.2 million in retirement. If we started early and keep at this for 40 years it explodes to over $5.9 million. Now, those are nice big numbers, but how do we know that if it's enough to retire? This is where one of my favorite data driven personal finance assumptions comes in: The 4% Rule.

📌 A deeper dive into the math and research behind this rule is coming in a future post. If you are super interested in this now, please check out this book: The Simple Path to Wealth

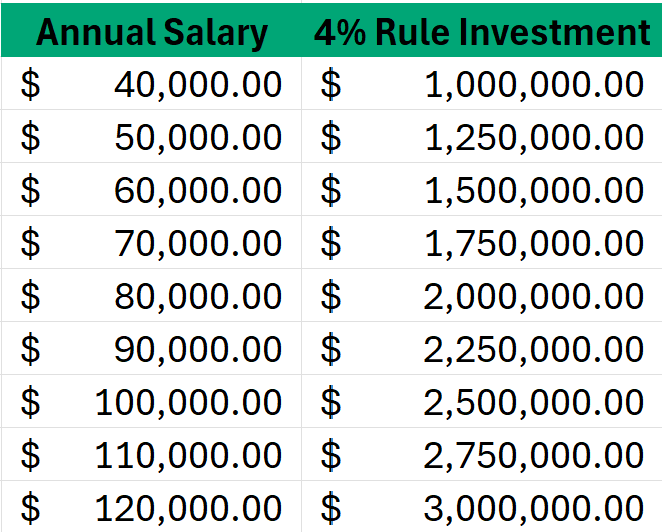

For now, here's a quick summary of the 4% Rule. This rule is well explained in The Simple Path to Wealth by JL Collins and is based on decades of historical market data and is one of the most practical answers to the question: “How much can I safely withdraw in retirement?” The rule suggests that if you withdraw 4% of your investment portfolio in your first year of retirement, and adjust that amount for inflation each year, you have a very high probability of never running out of money over a 30-year retirement, and in many cases it actually grows beyond your original balance. This isn’t just a hopeful guess; it’s rooted in extensive research, most notably the Trinity Study, which analyzed various market conditions over time. A balanced portfolio of low-cost index funds (like the ones Collins advocates, especially a mix of U.S. stocks and bonds) has repeatedly shown it can support that withdrawal rate, even through recessions and bear markets. It really shows that a well-diversified portfolio and consistent investing can give you real, data-backed financial freedom.

So what does this rule tell us? It says that when just 4% of our investments equals our annual spending, we can have a statistically safe retirement! If we've been tracking our annual spending using a budgeting program like YNAB, we can find this annual spending amount very easily. Another simple and conservative assumption is to use our annual salary as our annual spending. So let's see how much we need for different salaries/spending in order to meet our 4% Rule.

For our example above with a $60,000 annual salary, we need about $1.5 million in order to safely say we can retire. Looking at our graph, that will take consistently investing 15% of our gross income for 27 years.

Thanks to the math behind percentages and compound growth, this 27-year timeline holds true across any income, not just $60,000 specifically.

As with any long-term planning, there are a lot of assumptions and simplifications going on here. We're assuming there's no change in salary over our career, we have perfectly consistent and average 7% gains in the stock market, and we contribute that 15% bi-weekly for our entire career. But, as we all know, life is hardly this clean.

What Could Affect That Number?

Now that we've established that the 15% rule of thumb is robust, let's look at how we might need to adjust that based on our personal situations.

Starting Late?

Depending on how deep into our career we are, we may need to consider saving upwards of 20%-25% in order to reach our magic 4% Rule retirement account balance by the age we want to retire.

Started Early?

Did we start our Roth IRA at 16 and on track to save consistently save every year? We might be able to lower our contributions to 10%-12%, but it's still wise to aim for 15% and realize that we have a bit of flexibility now!

Employer Match?

Does our employer offer a match to our TSP/401(k)? That counts towards our 15%! Federal employees get a 100% match up to the first 5%, so we only need to contribute 10% of our salary to reach our desired 15%.

Low-Cost Lifestyle or FIRE Goals?

The 2 most important metrics in retirement are how much we have and how much we spend. If we have a low-cost lifestyle, this can greatly affect our 4% Rule investment amount. Every $5000 less we spend yearly, that's $125,000 less we need invested to safely retire. Spending matters just as much as saving!

High-Cost Living or Lifestyle Inflation?

Planning to travel the world or enjoy the finer things in retirement? Or really enjoy the benefits of living in a High Cost Of Living (HCOL) area? We should probably consider saving more than 15% to plan for that kind of lifestyle.

The Paycheck Game Plan

Let's breakdown how to hit that 15% using our various retirement accounts.

We have access to 2 (or 3 if we have an HSA) retirement accounts:

- 401(k) or TSP

- Individual Retirement Account (IRA)

- Health Savings Account (HSA) (if we have a High Deductible Health Plan (HDHP) and don't generally use these funds for health expenses during our career)

Much like we talked about when choosing between Roth and Traditional IRAs in Step 8, 95% of the value here is just getting the 15% saved! Splitting hairs over the most ‘optimal’ strategy is more of a thought experiment than a life-changing tactic.

Here's the gameplan:

- Get our employer match with TSP/401(k) (This is a must do. See Step 4.)

- Contribute to our IRA

- Contribute to our TSP/410(k) until we reach our 15%

The reason we switch back to our IRA here is that IRAs generally give us more control, flexibility, and sometimes lower fees on our investments. But, because the IRA limits are usually not enough to reach our 15%, we need to eventually switch back to our TSP/401(k) which has a much higher limit.

Start Where You Are

Not quite saving 15% yet? That's okay! Let's go over some strategies to reach that goal.

First, if we're not receiving our full employer match, we need to increase our contribution immediately. This is non-negotiable. This is literally free money and one of the highest leverage things we can do in regards to retirement. Go back to Step 4 if you still need more convincing!

Now that we have that out of the way, let's see how we can get to 15%. Thankfully, if we already capturing our full employer match, we're probably already around 10% contributions. Only 5% more to go!

One of the easiest ways to ease into increasing our contributions is to use promotions or annual raises to almost trick ourselves into contributing more. Did we get a 2% raise this year? Let's increase our contributions by that 2% and never even get tempted to see that money enter our bank account. The same goes for promotions.

One more option is to just increase our contributions 1-2% every year until we reach our 15%. Slow and steady wins the race here. We might even find that getting up to 20% using this method is actually more comfortable than we thought!

Why This Benchmark Is So Important

By contributing 15% and reaching our 4% Rule, we are making a pivot in our financial life from relying on employment, government, and luck, to relying on ourselves. This gives us true personal freedom an additional options on how we want to spend the rest of our lives. Saving for retirement is the longest-term goal in personal finance and starting as early as possible makes things way easier. Time is truly our greatest advantage here! The second most important factor here is consistency. Our freedom is built paycheck by paycheck.

Final Thoughts - One Percent Better

Just one final reminder that 15%, while we proved is a robust rule of thumb, is still just a guideline. There are so many assumptions and other personal factors than can adjust this number up or down. Finding that number that makes us comfortable and that we can prove is enough to get us through retirement is so incredibly valuable. It gives us a goal to reach for and the personal freedom that comes with it is worth the sacrifice.

Even if we’re not at 15% yet, a 1% increase today is a thank-you note to our future selves.

Base10 Basics Conclusion

Congratulations reaching the end of the Base10 Basics!

If you’ve followed along and taken to heart the importance of personal financial planning, you’ve built something truly powerful: a life of growing freedom, security, and choice. If you're still working your way through the steps, that's great too! Taking an active and intentional role in your personal finances is the first step towards financial freedom.

Let's quickly recap everything we've talked about:

First, we built awareness around our spending (Step 1), taken control of our cash flow (Step 2), and prepared for the unexpected (Step 3). Next, we learned to invest with intention. Starting with the employer match (Step 4), tackling debt head-on (Step 5), and building retirement savings (Steps 6 through 10). We even began to think about our income as an asset, and ourselves as the most important investment of all (Step 9).

That’s more than a foundation. It's a bulwark that’s robust, withstanding of setbacks that can ride out the unexpected with a clear mind and a strong financial base.

Next Up: The Tax-Free Trifecta ([Optional] Step 11: The HSA)