Level Up (Step 9: The Investments in Self)

The Shift from Survival to Strategy

We've built a strong financial foundation, paid off debt, built emergency savings, and started investing in our IRA. Now it's time to shift gears from staying afloat to strategic growth. Investing in yourself is the next powerful step you can take. This isn't just about signing up for another course (although that may be an option), it's a holistic look of our life and career trajectory. In order to understand the growth we are looking for, we need to understand where we are and where we want to be. The gap between where we are and where we want to be. That's our motivation.

The core message we'll keep seeing throughout this post is being intentional about protecting and growing our income. The consistency of a stable income in addition to career growth can exponentially grow our wealth when invested over a long time horizon, as long as we don't let lifestyle inflation (or actual inflation) eat it away.

Wondering how we built this strong financial foundation? Check out the Base10 Basics page. It's taken a lot of work and grit to get here. From not knowing where our money was going to already investing for retirement, we've come a long way and that should be celebrated!

This post is a long one, but has been my favorite to write so far. So please stick with me! Let's jump in.

Protecting Your Income (Consistency is Key)

Each of our personal income situations is different, so not all of these will apply to everyone. These are just some examples. We'll need to think through exactly what things we need to invest in for our own situation. But the key point here is we want to protect our income. Having a consistent income is the key to long-term growth. Getting ahead of potential issues and being intentional with our spending is so important here.

Physical & Logistical Supports

- Reliable Transportation. If our ability to work depends on getting somewhere, our car isn’t a luxury, it’s income protection. Start saving to replace it if necessary.

- Tech & Tools. Rely on a laptop, a toolset, or certifications? Maintain them well.

Mental Health & Burnout Prevention

- Burnout is expensive. It can lead to lost wages, missed opportunities, and stalled promotions. That's not to say that there isn't a time where you need to switch jobs. If we truly believe that a certain job's income isn't worth the stress, start looking for alternatives. The short-term pain of switching jobs is worth the long-term gain of stability and better mental health that comes with a proper fitting job.

- Mental upkeep is real upkeep. Budget time and money for rest, therapy, hobbies, social connection. If that means taking a day off to play your favorite video game that just got released, do that! It's all about finding what works for you.

- This is my favorite section because spending here feels like a luxury, but it’s a long-term play!

Job Security and Skill Maintenance

- Stay relevant. Our job may feel secure today, but industries change fast. We should always consider volunteering for a larger role in our workplace. We never know where the opportunities might lead. But also make sure that we're not getting taken advantage of in the long term. Short-term trials should lead to permanent promotions sooner rather than later.

- I highly suggest a yearly personal “performance review” and career health check. I have done this for the last 2 years and it has helped me immensely. Here is the baseline I use from Sam Matla. Suggest checking out his YouTube channel and newsletter as well if productivity and personal reviews are something you are interested in.

Growing Your Income (Beyond Inflation)

If our raise doesn’t beat inflation, it’s not a raise. It’s a quiet pay cut.

Know Your Baseline

It's best practice to compare our annual raises vs. inflation. For general inflation rates, keeping track of Consumer Price Index (CPI) headlines can go a long way. However, these are a very generalized, and not always entirely accurate, but certainly get us in the right ballpark. Everyone has their own purchasing habits, diet, cost of living, and commuting costs. Tracking our expenses via YNAB can be incredibly valuable here. Once we have a couple years worth of expense data, we can go back see where our spending has increased year over year.

This almost feels like a callback to Step 1: The Budget, where being aware of where our money is going is so important. Once we have data we can find our baseline and establish trends. Then we can make lifestyle changes based on those trends. But it all starts with tracking our expenses and collecting that data. The sooner we start the better!

Increase Value at Your Main Job

There are so many ways we can increase our value at our jobs. Every person's role and every job is unique, so there's no one-size-fits-all solution here. Rather, keep an eye out for some opportunities that fall into these categories:

- Look for certifications, credentials, or cross-training that align with raises or promotions. These are some of the more obvious paths, and we should absolutely take advantage of them. If there are clear cut paths to raises or promotions, start working towards them immediately.

- Work on the soft skills. Public speaking, Excel wizardry, Data visualization, Leadership courses, Time Management and Productivity courses and books, and building trust and staying out of workplace drama. These skills can go a long way in a workplace. A productive person who knows how to manage their time and communicate effectively with others is exactly who gets promoted. This is more than just taking courses too. It's about actually practicing them in the workplace.

- Look for opportunities to work with other groups or on projects that put us outside of our comfort zone. Having a well-rounded resume and lots of contacts in our organization can go a very long way if we are looking to move around and try something new. Name recognition and a good reputation are huge. This may also look like tackling that problem, task, or project that no one wants to touch and doing it really well. That speaks volumes to those around us.

Each of these is an intentional choice for our career. These most likely won't just fall into our lap, but they can have such a large effect on our future income and opportunities.

Explore Other Income Streams

- Side gigs like consulting, tutoring, niche content, or e-commerce can give us that extra income bump we need. Be sure that this balances with the rest of our lives though. Taking this on could mean extra time, stress, and possibly commuting, which can lead to spending more money and time relaxing. If it comes out to a net zero, probably best to find something else. It's about finding something sustainable.

- Entrepreneurship can be a great way to go too if there's something that's aligned with our passions or existing expertise. It can make the mental barrier to entry very low and the potential reward very great.

- Overall the goal here is to plant seeds now that we can nurture with the potential to harvest later. And an extra couple hundred bucks every month is nothing to sneeze at.

📌 I'm planning a deep dive post on the important of multiple income streams later!

Avoiding Lifestyle Inflation (Comfort Without Compromise)

You didn’t work this hard just to feel broke again at a higher income.

A leaky bucket won’t help you no matter how much water you pour in.

Recognize It First

Lifestyle inflation is sneaky. It often shows up as "maybe just this once..." kind of expenses that can quickly become expensive habits. We can become so accustomed to these spending habits that we hardly notice them until they've become so ingrained in our lives that stopping them becomes extremely difficult.

One tip for slowing down to recognize where this could be happening is to attempt a "buy nothing" week. By committing to buying nothing for a week, we can separate the money from the habit. If we have certain habits that we spend money on every day or week (morning coffee, bars/alcohol, eating out, entertainment spending, etc.), they quickly become apparent as we go throughout our week. Our first instinct may be to swing by the coffee stand, where the barista already has our drink ready. That habitual swipe of the card becomes automatic and expensive. By stepping back we get a greater awareness of these habits and how we can curb them. (Just warn that barista you won't be there ahead of time...)

These are just the small examples too. Bigger houses, faster cars, and fancy restaurants will derail our finances even faster! We'll talk more about these below.

Spend Better, Not Bigger

This is not all to say that as we make more money that we should not enjoy some of it. There are absolutely some extra expenses that create such great value and comfort that "splurging" on them can be well worth it.

- Add comfort where it matters. It could be a new mattress, air conditioning, better groceries, therapy, or even a more ergonomic workspace. I spent my first year moved out of my parents with no air conditioning and suffered for that entire summer. I would work overtime just to stay in an air conditioned office some days. Guess what my first major expense was when I got my first raise? Yeah, an air conditioner.

- Focus on value-per-dollar, not flash-per-dollar. It means that if we have something that works just fine, but a newer, better, and upgraded version of it comes out, (cough phones cough), maybe we can forgo an upgrade until we absolutely need it. This applies to so many things from cars to kitchen gadgets. Sometimes, the early upgrade is worth it. Just be sure that we are being intentional about it and can justify and explain why we are upgrading.

Unacceptable Lifestyle Inflation Examples

Keeping up with the Jones's is a very real of lifestyle inflation phenomenon and it happens all the time. One way to recognize it is if we start talking about buying a new car or moving to a new house or neighborhood shortly after envying someone else who just did, we may already be in too deep. We should have materially good and explainable reasons for making large purchases like these.

The other prime example here is unintentional subscription creep. We may be surprised once we sit down and realize how little we use some of these subscriptions. Only watch the new episodes of The Last of Us each week on Max? We just paid nearly $5/episode. Forget to stop that subscription after the new season was over? $21/month out the window with nothing to show for it. It's the little things like this that matter. Subscriptions that are intentionally used can be of great value. But low use or forgetfulness can be costly.

Siri, remind me to cancel my Max subscription...

Set Guardrails

Let's talk about some guardrails that we can set up against lifestyle inflation.

- Use target-based budgeting to limit unintentional creep. If we use YNAB this will look like setting aside a specified amount each month in a particular category and sticking with it. Another great example is Dave Ramsey's envelope method.* Both methods have us setting aside a certain amount of money to avoid overspending. Doing this every month or week will help reign in lifestyle inflation.

*I don't recommend Dave Ramsey content very often, but this is a good one and actually aligns very well with the YNAB philosophy. However it relies very heavily on cash, which is good for the increased mental pain attached to spending cash vs. swiping a card, but the reality is that cash is being used less and less in our society. YNAB does the same thing, but all digitally.

- Consider a “give-yourself-a-raise” system. Each new income bump = % to fun, % to investments. This gives us the best of both worlds. More investments and more fun! Just make sure that % split makes long term sense.

Investments are fun... Right?...

Compound Growth: Why This Step Matters So Much

The best part of investing in ourselves? It directly feeds our ability to invest financially.

Let's wrap up all of this and talk about why this step is so important. We have the opportunity here to create an inflection point in our lives. Here’s why, broken down into the Four Pillars of Investment Growth.

Four Pillars of Investment Growth

- Initial Investment – We’ve done that work already (emergency fund, debt paid, starter IRA). We've put ourselves in a spot where we can start investing.

- Periodic Contributions – This is where Step 9 shines. By growing income and avoiding lifestyle inflation, we can increase our monthly investments.

- Rate of Return – This is largely out of our control, but we can control our consistency.

- Time – The longer we have, the better off we'll be. However, we don't have much control on time other than starting as early as possible.

"The best time to plant a tree was 20 years ago. The second best time is now."

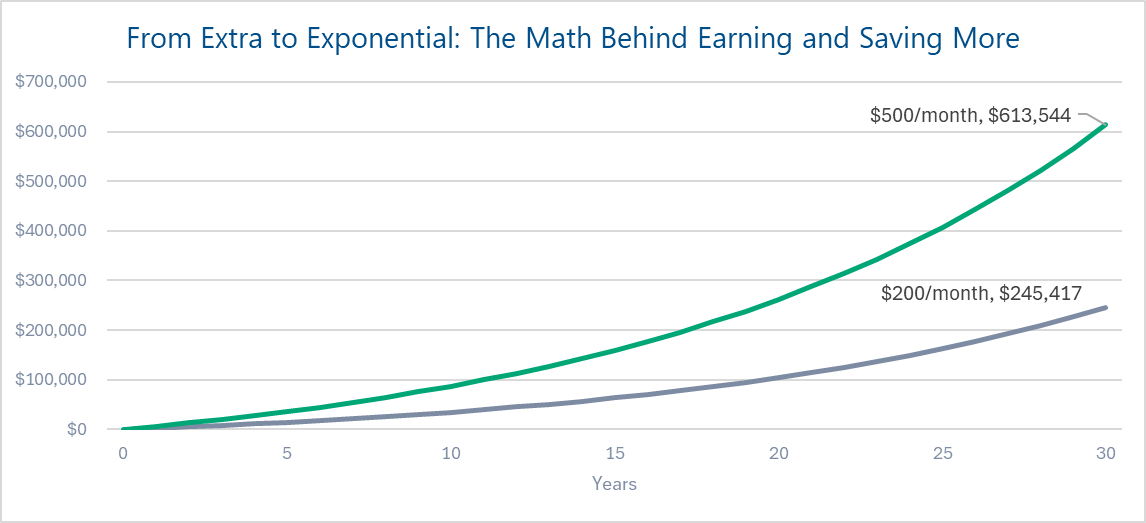

Let's take look at what investing $200/month vs. $500/month looks like:

Initial Investment: $0

Periodic Contributions: $200/month vs. $500/month

Rate of Return: 7% (Average real return of the stock market)

Time: 30 Years

This is the point that we really need to drive home with this whole post:

Earning more and spending less while investing the excess will change our lives.

Lifestyle inflation with the wrong purchases will create an anchor of unhappiness that will keep us grinding with nothing to show for it in 30 years. These changes don't just happen. They're intentional choices we need to make every single day.

That's not to say every day will be perfect. Some days we may need that coffee stop in the morning. Or maybe our old gym clothes were still perfectly fine, but we bought new ones anyway hoping it might give us a little extra motivation to finally get back to the gym. Overall it's about being intentional with our decisions.

Final Thoughts – You Are the Asset

We covered a lot in this post. Let's recap everything.

- This step is the most personal. We discussed a lot of examples, but they are just that, examples. Keep an eye out for where you can create leverage in your own life.

- Protect your income, grow your skills, avoid unnecessary spending creep, and invest in what truly matters to you and you can justify, but not at the expense of your health: mental or physical. Your health is your wealth. Take care of yourself and a lot of other things will take care of themselves.

- The goal isn’t hustle culture. It’s intentional decisions in our day-to-day that greatly affect our future.

Only you know what will truly move the needle in your life and career. When you start thinking long-term, the short-term trade-offs start to feel a lot smaller. So take a step back, look ahead, and ask yourself: What’s one thing you can invest in today that your future self will thank you for?

Thanks for sticking with me on this one.