Protect Your Progress (Step 3: The Emergency Fund)

The Emergency Fund is an overlooked piece of a solid financial plan; it's not your credit card, your investments, and definitely not your retirement accounts. Your Emergency Fund is cold hard cash in a savings account where the market can't touch it. Your first Emergency Fund goal should be $1,000. We will look at:

1. Why $1,000 is an important number

2. How your emergency fund can actually save you money

3. Strategies on how to build that $1,000 of financial security

First, I have a confession to make: I don't have an emergency fund right now. GASP... Now, this isn't a case of "Do as I say, not as I do." I am in the process of building my emergency fund for reasons you will need to understand a bit of my background and personal situation: I have been employed by the federal government, specifically the Department of Defense, for over 7 years. Until the recent administration, federal employment has been one of the most stable jobs in the country. (Only with the occasional threat of a government shutdown every year notwithstanding...) Basically, my emergency fund was my job. Paid every other week. Like clockwork. I know (knew?) that I have a paycheck coming in every other week until I retire at 57 years old. Now, with that out in the open, let's dive into why that first $1,000 is so important!

Why $1,000 Is An Important Number

Saving $1,000 can seem like a daunting task if you're starting from nothing. If you have followed along with Step 1: The Budget and Step 2: The Essentials, you have a good idea of what money you have and where your money is going. Your Emergency Fund should be the first thing you start to build after covering your essentials. $1,000 in your emergency fund is significant for several reasons:

First, it shows you can set aside money instead of jumping at the next shiny thing in front of you (trust me, video games are my vice). Foregoing the immediate gratification of buying something you want and trading it for long-term financial security is a sign of maturity that can positively affect many other parts of your life.

Second, the actual number "$1,000" is important because it can cover most small emergencies that plague our everyday lives, while still being an achievable number. You know those unexpected expenses that pop-up and just derail your entire financial plan like: A flat tire that can't be repaired and needs to be replaced, home repair emergencies like plumbing or maybe a locksmith, last minute flight for a family emergency, or even an emergency visit to the vet for your fur baby? Life is complicated and expensive. It's best to be prepared for anything that comes our way.

Third, the psychological peace that comes from having $1,000 set aside is invaluable. Life will always throw unexpected expenses outside even the best financial plan. Having set aside money dedicated to these inevitable surprises that life throws at us can help us sleep at night, reduce the stress of an emergency, and help us roll with the punches.

How Your Emergency Fund Can Actually Save You Money

It's about time we got into a little bit of math (sorry, I'm an engineer) with my favorite topic - Interest Rates.

Let's go over an example of an average $500 emergency. We'll cover 2 scenarios, first without an emergency fund, second, with an emergency fund.

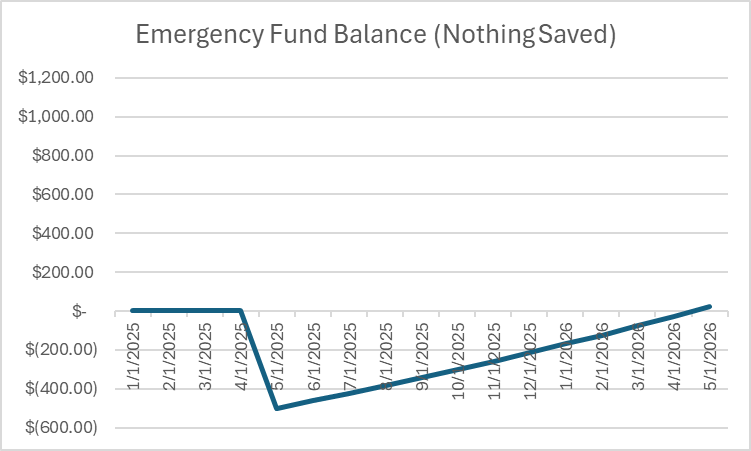

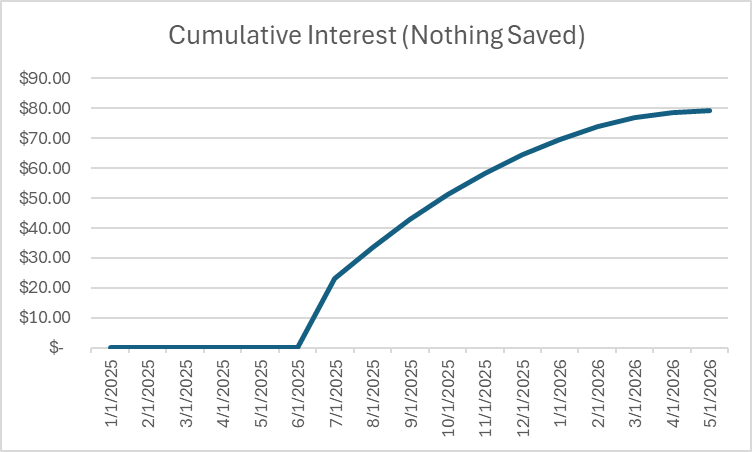

If you don't have an emergency fund, generally your only option for covering an unexpected $500 expense will be to put it on a credit card and pay it off over time. Let's take a look at what that might look like:

Assumptions:

1. $50 of extra cash each month to pay down debt/rebuild emergency fund

2. Credit card interest rate of 29%

3. $500 expense occurs in May 2025.

In this case it will take you until May of 2026 (12 months!) just to pay off your $500 emergency and you will have paid nearly $80 in interest to the bank. That puts you nearly an additional 2 months behind on your savings with the $50 per month assumption, while still being exposed to the possibility of another emergency.

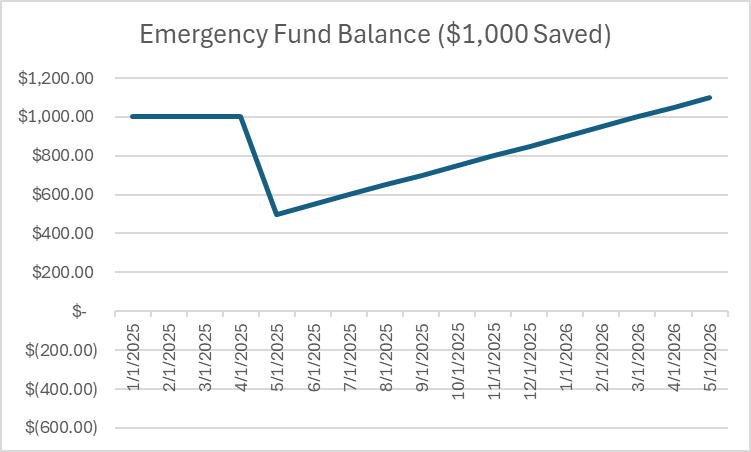

Now let's look at what your Emergency Fund would look like if you already had $1,000 set aside for this exact emergency:

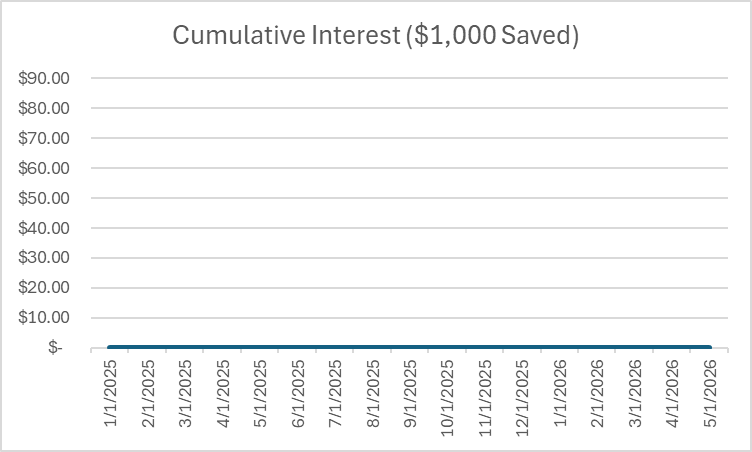

When you have $1,000 set aside specifically for emergencies, it gives you breathing room so you don't get charged the ridiculous 29% interest on credit cards.

You have paid $0 in interest to the bank and you have recovered your entire emergency fund by March of 2026, only 10 months. And you are already prepared for the next emergency. I am also ignoring the fact that you probably have your emergency fund in a High Yield Savings Account that also pays YOU interest, instead of you paying the bank. Your emergency fund is your bulwark against credit card interest rates.

Strategies On How To Build That $1,000 Of Financial Security

If you have a job that already allows you to easily cover your essential expenses with some leftover cash each paycheck, that's great! Your goal should be to build your $1,000 Emergency Fund as quickly as you can. You never know when your next emergency will happen!

For those who find themselves on their heels every time an emergency hits, here are some suggestions on how to build your Emergency Fund:

- Start by setting aside something every paycheck. Even $5 every week can eventually build into something significant. However, it will take a while to build your $1,000 based on this alone, but it will create a sense of long-term thinking in your finances that we covered earlier.

- Set aside all or most of any unexpected income. This can come in many forms, but try to think of any money outside of your normal paycheck that comes into your account. Most commonly, this might be your tax refund in April. It could also be a settlement from a class action lawsuit, credit card rewards, or a refund on insurance payments. These are simply examples; be on the lookout for unexpected income that can be set aside.

- Work overtime, extra shifts, or second job. This is my least favorite option, but it's worth mentioning it because the Emergency Fund is that important. I don't buy into hustle culture, but the financial peace of mind that having your $1,000 Emergency Fund brings is so valuable that the short term pain is worth it. Just make sure you actually set aside the money.

You don't need to have it all figured out today and your Emergency Fund filled tomorrow. But your future self will thank you for starting. Build your buffer, buy your piece of mind, and keep making small steps forward. This is what it's all about.

Next up: Step 4: The Employer Match