Slow Leak, Steady Sink (Step 7: The Moderate Interest Debt)

Why Tackle Such Low Interest Rate Debt?

Even though these debts won’t sink our finances the way credit cards can, they still carry weight. Both financially and emotionally.

Moderate-interest debts may feel “manageable,” but they’re still quietly eating away at our wealth in the background. Think of them like a slow leak in a boat: not catastrophic, but definitely not something to ignore.

Today we’ll cover:

- What Counts as "Moderate Interest" Debt

- Why Tackle These Now

- BUT I REALLY WANT TO START INVESTING NOOOOOW!!!

- Avalanche vs. Snowball: A Quick Refresher

Before we dive in, take a quick glance at where we are in the Base10 Basics roadmap. Last time, we covered The Parachute Fund—our financial safety net. Now, we’re finally leaving emergency mode and inching toward real wealth-building.

What Counts as "Moderate Interest" Debt?

Moderate interest debt typically lives in the 5%–10% interest range. It’s not an emergency, but it’s still costly over time.

Common examples:

- Auto loans

- Student loans

- Personal loans

- HELOCs (Home Equity Lines of Credit)

You might be thinking, "Wait, aren’t mortgages in this range too?" Great catch. But mortgages are a different beast. Why?

- They often have the lowest interest rates you’ll get.

- They’re paid off over 30+ years, so inflation actually helps.

- They’re often considered "good debt."

- They can be refinanced.

So for now, we’re putting mortgages aside.

📌 We’ll do a deep dive into mortgages later.

📌 Deep dive into Good Debt vs. Bad Debt also coming!

Why Tackle These Now?

Because we’re almost ready to invest! But not quite...

Moderate-interest debt is just annoying enough to cause friction. And if we try to invest while still paying off 8% or 10% loans, we’re basically trying to build wealth while it’s leaking out the back door.

Here’s the mindset shift:

Paying off debt is like investing with a guaranteed return. (We touched on this in the Credit Card Debt post!)

If your loan has a 9% interest rate, every extra payment is effectively a 9% return—risk-free. We're saving interest instead of earning interest. That 9% is right up there with long-term stock market returns, without the volatility.

📌 A deeper dive into “Paying Off Debt vs. Investing” is coming soon—but this is the key takeaway for now.

Oh! And let’s not forget the emotional benefit:

No more monthly payments quietly draining our bank account. No more credit hits if we miss one. Less stress, more freedom.

Think of it this way:

What’s the point of earning interest while you’re still paying interest?

In one hand, out the other!

BUT I REALLY WANT TO START INVESTING NOOOOOW!!!

Okay okay. I hear you!

And here’s the good news: we’re in a strong enough position that we can start blending these steps together.

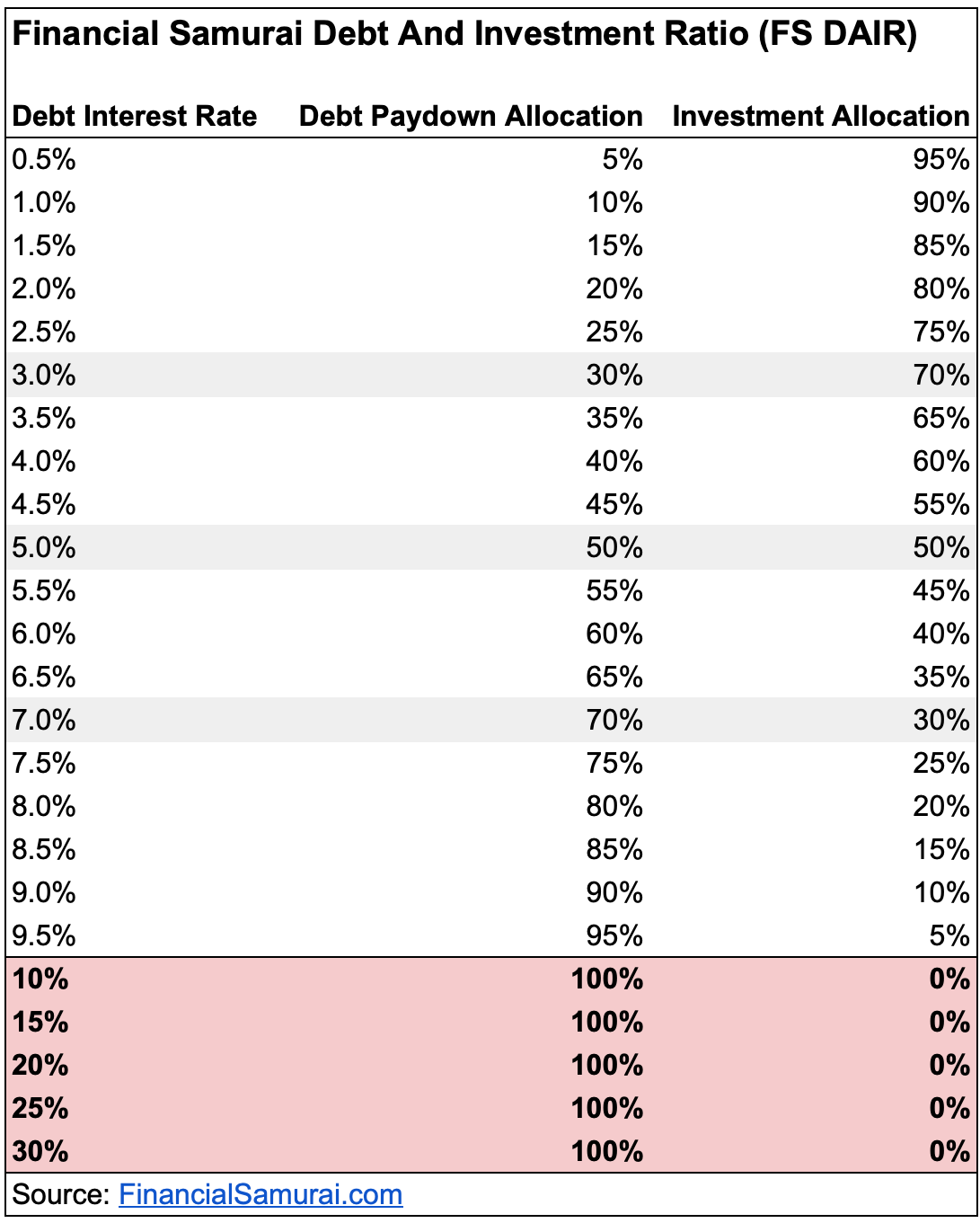

Let's introduce a simple framework from Financial Samurai that shows how we might split extra income between debt payoff and investing, depending on our debt interest rate:

We’ll explore why these percentages work in that upcoming deep dive, but for now just use it as a flexible guide.

Also: this is a great time to start learning how to invest.

Open a Roth IRA or a simple brokerage account and just start exploring. Buy your first ETF. Get a feel for the process, without taking on significant risk. That way, when it’s time to invest seriously, you’ll already be in the rhythm.

Need help picking an investing platform? Reach out. I’ve got recommendations.

Avalanche vs. Snowball: A Quick Refresher

We first touched on this in the Credit Card Debt post, but here’s a quick review:

- Avalanche: Pay off the highest interest rate first (saves the most money).

- Snowball: Pay off the smallest balance first (more psychological wins).

Both work. The key is to pick the method you’ll stick with.

From a purely mathematical point of view, avalanche wins.

From a motivational point of view, snowball might keep you going longer.

📌 We'll take a deep dive into the math behind each of these methods later.

Progress > Perfection. Always.

Stepping into the Future

If you’ve been following along through the Base10 Basics steps, you may have noticed a shift happening. Each step hasn’t just been about money mechanics, it’s been training your brain to think a little further ahead.

We started with the immediate stuff. Budgeting and covering our essentials. Thinking about how to make it to next week or next month without stress.

Then we zoomed out a bit: Building an Emergency Fund. This was our first nod to the unknown, the unexpected. We were thinking in terms of months to a year. What if the car breaks down? What if there's a medical bill?

Next, we claimed our Employer Match—a peek into the future, where interest rates and compounding returns started to matter. Still short-term action, but with long-term impact.

Then came the Credit Card Debt. That was our moment to stop the bleeding. It’s hard to assign a timeframe to it, because credit card debt doesn’t just hurt your wallet, it clouds your whole financial picture. But getting rid of it opens the door to clear skies and real progress.

With the Parachute Fund, we imagined bigger what-ifs. What if we lost our job? What if we needed six months to regroup? That’s thinking in terms of 5 to 10 years, preparing for big shocks and building real security.

And now here we are, looking at Moderate Interest Debt—the slow leak, the steady sink. It might not knock you down next week, but left unchecked, it can quietly erode your future for decades.

See the pattern?

Each step is stretching your financial imagination. Each decision builds toward a life that’s not just reactive, but intentional.

And next? We take our first real step into the 30+ year future. We’ll talk about The IRA—our first true retirement move. Not just protection, not just payoff, but growth and real, long-term wealth building.

We've come a long way. We're not just surviving anymore. We're setting sail.

Next up: Step 8: The IRA